louis vuitton taxes | The US Won’t Tax French Luxury Goods by 25% After All louis vuitton taxes At the Store: Request a tax invoice from the retailer and keep your original receipt. At the Departure Airport: Bring your paperwork and receipt, as well as the goods themselves. Travelers should have their goods on their bodies or in their hand luggage. Nitofill LV is a high strength, low viscosity resin injection system and provides excellent bond to concrete and masonry. The Nitofill LV system is ideal for small scale repairs on site and is also suitable for insitu or precast concrete elements. Advantages. Suitable for structural crack repairs.

0 · The US Won’t Tax French Luxury Goods by 25% After All

1 · LVMUY (Lvmh Moet Hennessy Louis Vu

2 · LVMH, Vinci to Face Biggest Hit From France’s Planned Tax Hike

3 · Do You Have to Pay Tax on Louis Vuitto

TOP 3 finālistu auto "Latvijas Gada auto 2024 Dizaina balva" nominācijā (+ VIDEO) Strīda par bruģi dēļ Liepāja var zaudēt Eiropas fondu naudu (+ VIDEO) 5. 140 dalībnieki, nedēļas nogalē Biķernieku trasē, atklās Latvijas drifta sezonu. Latvijas drifta sezona šogad tiks atklāta ar divu dienu sacensībām.

The Louis Vuitton store at La Samaritaine in Paris. . While plenty of French companies may be hoping the government’s proposed €8 billion increase in corporate taxes remains a temporary .The US has suspended plans to impose tariffs of 25 percent on French luxury goods, due to take effect this week in response to France’s tax on big tech companies like Facebook and Amazon. The Louis Vuitton store at La Samaritaine in Paris. . While plenty of French companies may be hoping the government’s proposed €8 billion increase in corporate taxes remains a temporary . The US has suspended plans to impose tariffs of 25 percent on French luxury goods, due to take effect this week in response to France’s tax on big tech companies like Facebook and Amazon.

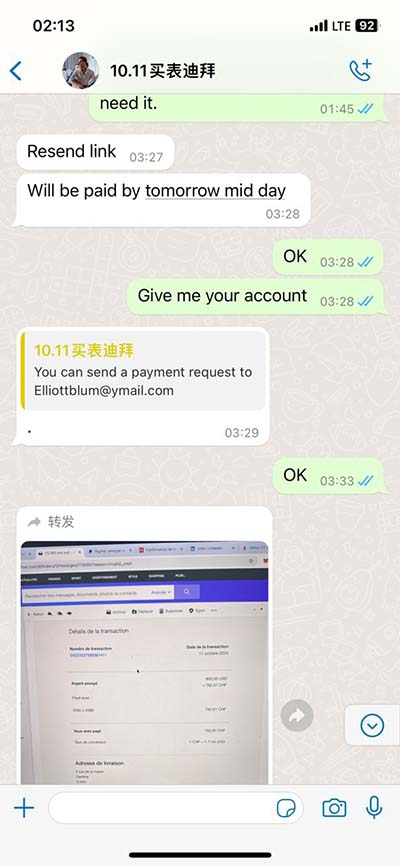

At the Store: Request a tax invoice from the retailer and keep your original receipt. At the Departure Airport: Bring your paperwork and receipt, as well as the goods themselves. Travelers should have their goods on their bodies or in their hand luggage.

The ruling will directly affect French luxury behemoths LVMH, whose brands include Louis Vuitton, Christian Dior, Celine, Fendi and Marc Jacobs, and Kering, who counts Gucci, Saint Laurent . - LVMH opens several manufacturing facilities each year in France, notably for Louis Vuitton. - Five billion in corporation taxes paid worldwide, almost half of which in France. - More than one billion euros invested in France each year.Louis Vuitton annual income taxes for 2021 were .336B, a 93.9% increase from 2020. Compare LVMUY With Other Stocks. Louis Vuitton annual/quarterly income taxes history and growth rate from 2011 to 2023. Billionaire Bernard Arnault’s LVMH lost the latest round in its court battle against French tax officials who raided the luxury-goods firm’s Paris headquarters to gather evidence for a case. France’s top court on Wednesday overturned a prior ruling that had deemed the 2019 inspections to be unjustified.

In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury .LVMH Moet Hennessy Louis Vuitton ADR annual income statement. View LVMUY financial statements in full, including balance sheets and ratios. LVMUY (Lvmh Moet Hennessy Louis Vuitton SE) Tax Rate % as of today (October 21, 2024) is 27.05%. Tax Rate % explanation, calculation, historical data and more The Louis Vuitton store at La Samaritaine in Paris. . While plenty of French companies may be hoping the government’s proposed €8 billion increase in corporate taxes remains a temporary .

prada 80s bag

The US has suspended plans to impose tariffs of 25 percent on French luxury goods, due to take effect this week in response to France’s tax on big tech companies like Facebook and Amazon. At the Store: Request a tax invoice from the retailer and keep your original receipt. At the Departure Airport: Bring your paperwork and receipt, as well as the goods themselves. Travelers should have their goods on their bodies or in their hand luggage. The ruling will directly affect French luxury behemoths LVMH, whose brands include Louis Vuitton, Christian Dior, Celine, Fendi and Marc Jacobs, and Kering, who counts Gucci, Saint Laurent .

- LVMH opens several manufacturing facilities each year in France, notably for Louis Vuitton. - Five billion in corporation taxes paid worldwide, almost half of which in France. - More than one billion euros invested in France each year.Louis Vuitton annual income taxes for 2021 were .336B, a 93.9% increase from 2020. Compare LVMUY With Other Stocks. Louis Vuitton annual/quarterly income taxes history and growth rate from 2011 to 2023. Billionaire Bernard Arnault’s LVMH lost the latest round in its court battle against French tax officials who raided the luxury-goods firm’s Paris headquarters to gather evidence for a case. France’s top court on Wednesday overturned a prior ruling that had deemed the 2019 inspections to be unjustified.

In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury .

LVMH Moet Hennessy Louis Vuitton ADR annual income statement. View LVMUY financial statements in full, including balance sheets and ratios.

The US Won’t Tax French Luxury Goods by 25% After All

LVMUY (Lvmh Moet Hennessy Louis Vu

can you sell a prada bag

Motorcraft ® MERCON ® LV is a premium-quality automatic transmission fluid recommended by Ford Motor Company for use in Ford and Lincoln vehicles that require MERCON ® LV type fluid. This product also provides excellent performance in electronically controlled automatic transmissions.

louis vuitton taxes|The US Won’t Tax French Luxury Goods by 25% After All