rolex avoid sales tadx | should i buy a Rolex rolex avoid sales tadx Nelson says she saw Duan shipping empty Rolex boxes out of state to avoid . $11K+

0 · should i buy a Rolex

1 · sales tax on Rolex watches

2 · does Rolex pay taxes

3 · Rolex sales tax laws

4 · Rolex sales tax exemption

5 · Rolex sales tax avoidance

6 · Rolex no sales tax

7 · Rolex import duty

Updated August 24, 2022. Welcome to Brand Breakdown, a series of comprehensive yet easy-to-digest guides to your favorite companies, with insights and information you won’t .

hublot king power black magic watch

should i buy a Rolex

You should carefully check the tax laws concerning “use tax” if your state .If you owed the sales tax, it's not legal to avoid paying it. It may be no one charged you sales . Side note: I always find it curious, and frankly gross, when sales associates try to .

sales tax on Rolex watches

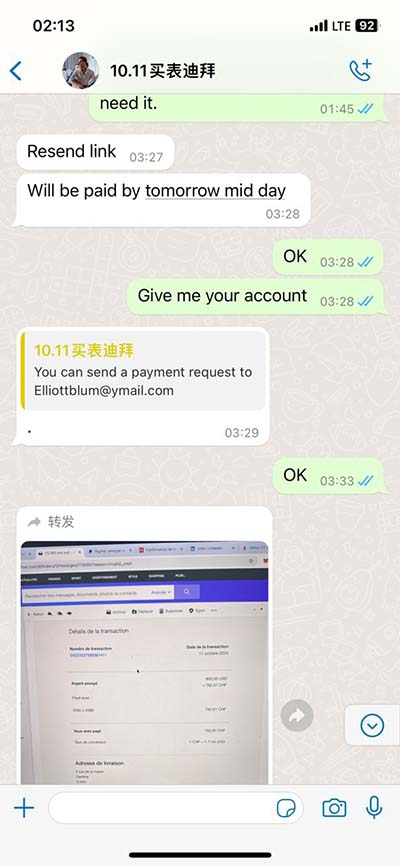

Nelson says she saw Duan shipping empty Rolex boxes out of state to avoid .

With this in mind, one of the most common questions potential buyers ask is: where can you buy a Rolex in the USA and legally avoid the payment of sales tax? The best way to achieve this is to purchase a Rolex online, although it is important to understand precisely how this works and what the limitations are. You should carefully check the tax laws concerning “use tax” if your state imposes a sales tax. If you purchase an item in a state with lower (or no) sales tax, you owe the amount of tax difference.

If you owed the sales tax, it's not legal to avoid paying it. It may be no one charged you sales tax, but that does not mean you don't owe it. Side note: I always find it curious, and frankly gross, when sales associates try to sweeten a deal by suggesting they ship a watch out of state to allow me to avoid sales taxes! Offering to aid and abet tax evasion is not the same as a discount on price.

The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one is 9101. Nelson says she saw Duan shipping empty Rolex boxes out of state to avoid paying sales taxes, and that some of the watches ended up abroad. In almost all states, you're supposed to pay "use tax" (generally equal to sales tax) when you bring it back to your state anyway. Like when you're doing your state filing on TurboTax and it's like "did you make any untaxed out-of-state purchases?" Avoiding the Disadvantages of Buying a Rolex at the Airport – Buy Online Instead. Ultimately, the decision of whether to purchase a luxury Rolex or other timepiece at the airport rests with you, but it is crucial to know the pros and cons before you commit to a purchase.

"Sales" tax is a tax on the transaction, not the good. Ergo, the sale of used goods are no less subject to a sales tax than brand new goods would be. Use tax is essentially an import tax imposed at the state level. It, similarly, applies to .Zero Sales Tax. If you purchase a Rolex from a dealer that operates outside of your home state, you won’t be subject to pay any sales tax. However, you could pay up to 8.25% tax on a watch purchased from an authorized dealer in your state. With this in mind, one of the most common questions potential buyers ask is: where can you buy a Rolex in the USA and legally avoid the payment of sales tax? The best way to achieve this is to purchase a Rolex online, although it is important to understand precisely how this works and what the limitations are. You should carefully check the tax laws concerning “use tax” if your state imposes a sales tax. If you purchase an item in a state with lower (or no) sales tax, you owe the amount of tax difference.

If you owed the sales tax, it's not legal to avoid paying it. It may be no one charged you sales tax, but that does not mean you don't owe it. Side note: I always find it curious, and frankly gross, when sales associates try to sweeten a deal by suggesting they ship a watch out of state to allow me to avoid sales taxes! Offering to aid and abet tax evasion is not the same as a discount on price. The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one is 9101. Nelson says she saw Duan shipping empty Rolex boxes out of state to avoid paying sales taxes, and that some of the watches ended up abroad.

In almost all states, you're supposed to pay "use tax" (generally equal to sales tax) when you bring it back to your state anyway. Like when you're doing your state filing on TurboTax and it's like "did you make any untaxed out-of-state purchases?"

Avoiding the Disadvantages of Buying a Rolex at the Airport – Buy Online Instead. Ultimately, the decision of whether to purchase a luxury Rolex or other timepiece at the airport rests with you, but it is crucial to know the pros and cons before you commit to a purchase. "Sales" tax is a tax on the transaction, not the good. Ergo, the sale of used goods are no less subject to a sales tax than brand new goods would be. Use tax is essentially an import tax imposed at the state level. It, similarly, applies to .

does Rolex pay taxes

Rolex sales tax laws

hublot chronograph skeleton

hublot avion arrache

Robust and functional, the GMT‑Master II is the ideal watch for criss-crossing the globe. On world time, crossing meridians. Two time zones at once. The GMT-Master carries its .

rolex avoid sales tadx|should i buy a Rolex